Techniques such as Stock Split can be performed to reduce the share prices. Reduce the price of shares to make them more affordable by the investors.Unregistered shares cannot be put on sale though they are released by the company. Register maximum number of shares with SEBI (Security Exchange Board of India) to ensure maximum shares are available for sale.This way, there are more stocks available to be traded by the investors. Difficult as the second step, companies can persuade the stock investors to choose to invest in common stocks over the preferred stocks. Investors love to invest in preferred stocks, and this could lead to low share turnover as the choices are over.It will be difficult for the companies to do so, but this is one of the best options. If the large stockholders release a good amount of stocks, more stocks will be available for purchase in the open market, which will lead to an increase in the share turnover. The second step is difficult because here, you have to persuade the large stockholders to release some portion of the large holdings.If the company lists stocks though the share turnover is less, it offers an investment opportunity to more investors. Listing on the stock exchange is the best solution to get more investors and increase the funds.

Bond turnover ratio formula how to#

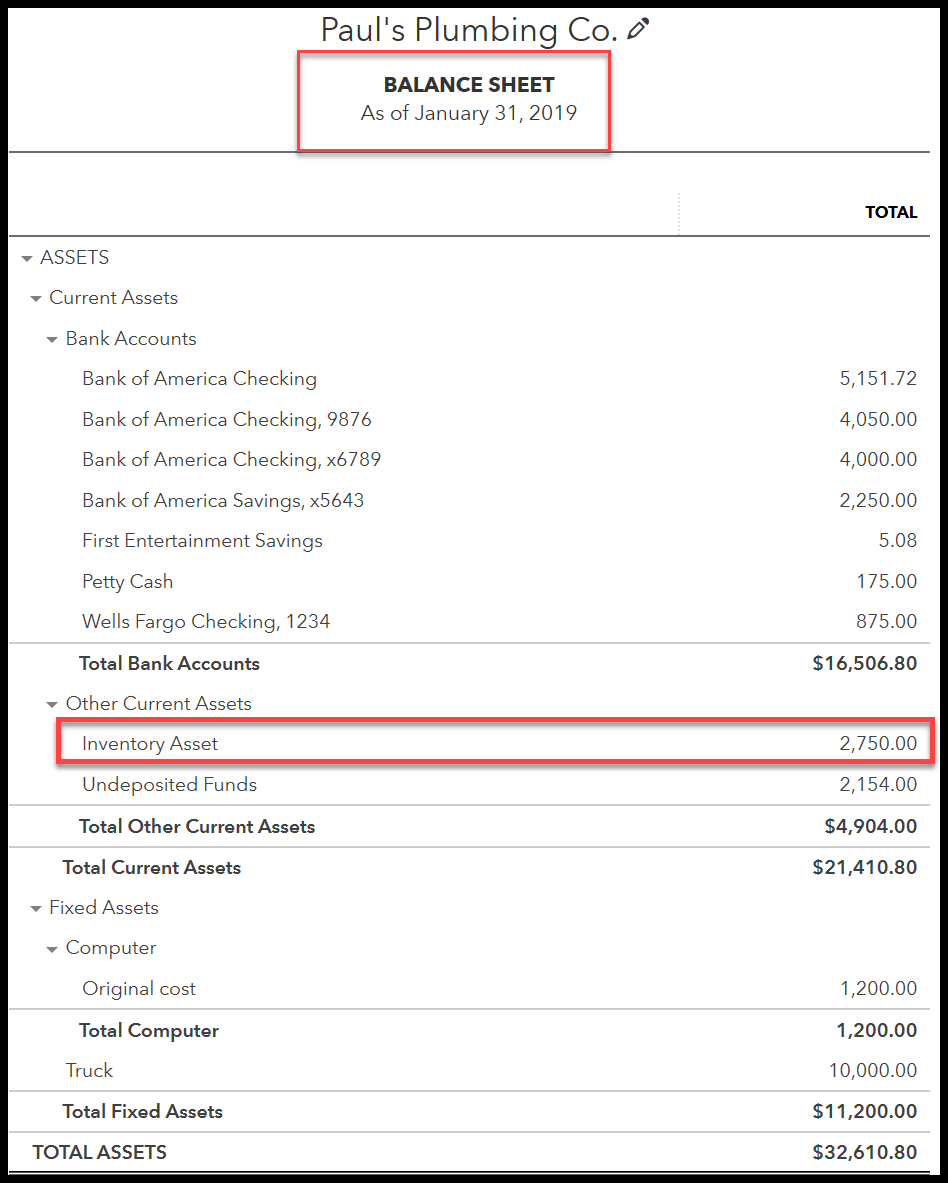

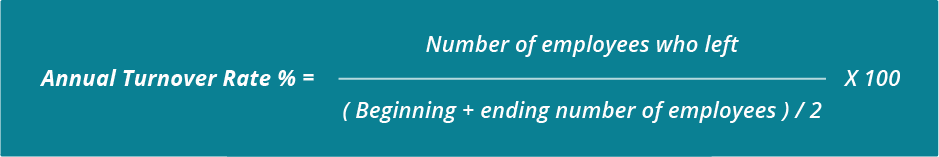

If there is a problem, there is a solution for it, and here is how to efficiently improve the share turnover of the company. These are the best ways to compare the turnover of the company to understand which company to invest in.Ī low share turnover implies difficulty in business, and this could cause serious damage and, in some cases, bring it down. Then, how do you compare the share turnover? The answer is simple you can compare with either the history of the company or with the company from a similar industry and position. Statistically speaking, you cannot compare the share turnover of a company in the food industry with a shoe industry, as they are different in nature the numbers of a particular company may differ from another. The Share Turnover ratio does not have a specific range for the stock market it is an industry-specific metric and differs among all the industries. Share Turnover Ratio = Shares bought during the trading volume / Share outstanding. Share outstanding - Total number of shares that are still available for purchase for the investors.A total number of shares of the company’s stock that were bought during the trading volume.To calculate the share turnover, we need to have more numbers. The share turnover is expressed in the form of a share turnover ratio or share turnover rate. Now that we know how important is share turnover, here is how to calculate it. If the share turnover is less, the stock marketers will face trouble liquidating the stocks in the near future depicting stock volatility. During this research, share turnover is an important metric as it will help you assess the situation of the company, similar to the floating stocks. You will be investing a good lump sum amount in these stocks, and a blind investment is a nightmare. As a stock marketer, good research of the company and the numbers associated with it is an important task. To keep the cash and stock-flow in the market, companies would need to track the share turnover over each quarter.Īpart from companies, stock marketers also need to pay good attention to a company’s share turnover. Besides, the stock volatility will also increase the low liquidity situation, which is not the best option for any company. This will lead to stock volatility as marketers won’t be interested in buying such stocks, and selling them will become a hard choice. If the companies are falling downhill with less performance, it is obvious that the share turnovers will show a lesser value. For companies, it is important to understand the share turnover value to know the performance in general. Share turnover is an important indicator for stock marketers, and it becomes extremely important for both the companies and the marketers to calculate them.

0 kommentar(er)

0 kommentar(er)